IR: Disclosure and IR Support Solution

Overview and Features

BizForecast IR is a function module that supports disclosure and investor relations (IR), specifically designed for publicly listed companies and companies conducting disclosure on an ongoing basis among our customers who already use our BizForecast Series (e.g. the Core module).

If your company is already using our BizForecast Series and has your financial consolidation or management accounting processes systemized, adding this BizForecast IR will enable you to manage on BizForecast additional processes. These processes include reclassifying of account titles to respective granularity levels for annual security reports (quarterly reports), short financial reports, and financial statements, as well as collecting and processing of qualitative information such as notes and remarks.

System Overview

Within the process of financial accounting and reporting, as shown in the figure below, BizForecast Series has been developed as a system solution with the goal of supporting all of the operational processes, except for non-consolidated accounting and reporting (incl. financial accounting and tax filing). BizForecast IR is a module (a function group) that supports collection, processing, reporting, and managing unitarily of disclosure data for external stakeholders.

Using BizForecast IR with other data collection or financial consolidation modules in BizForecast Series will immensely enhance the efficiency and accuracy of your disclosure processes.

Function Overview

Reclassification of Financial Statements for Disclosure

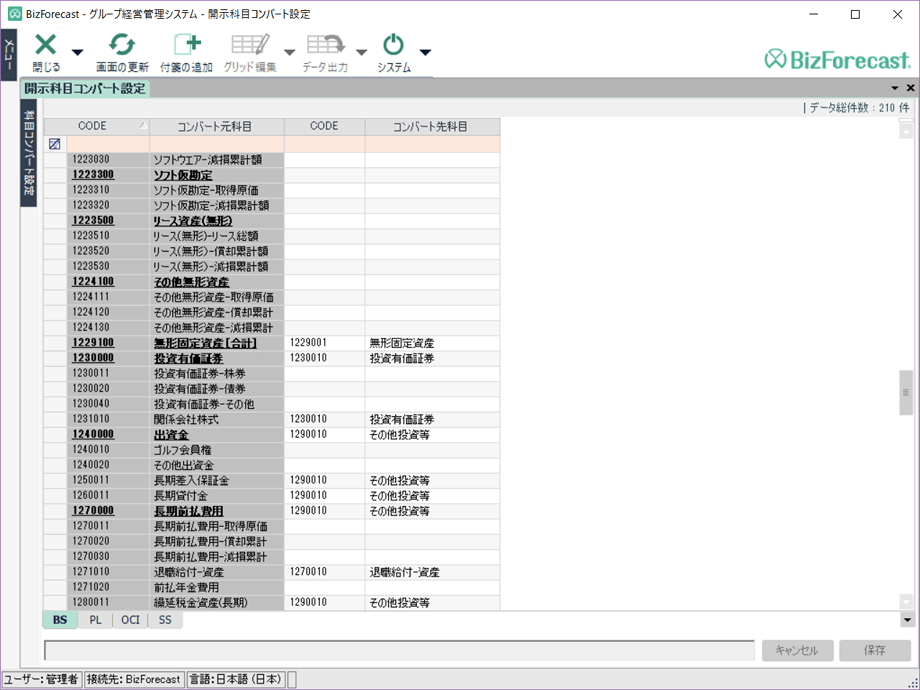

1. Master Settings: Reclassifications of Disclosure Items

On this screen, you'll make the settings for connection and granularity conversion between account items in consolidated accounting worksheets (or non-consolidated trial worksheets) and items in disclosure financial statements.

Depending on the purposes, you may define multiple sets of disclosure account trees, granularity conversions, and connection patterns. For example, you may create one set for consolidation and another for non-consolidation, or define one for annual security reports (quarterly reports) and another for financial statements.

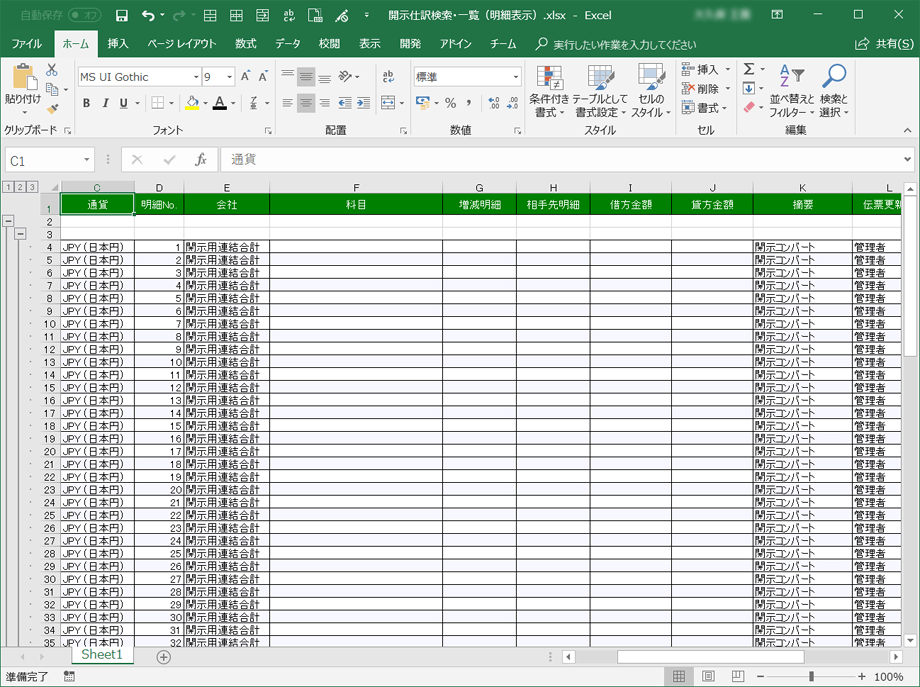

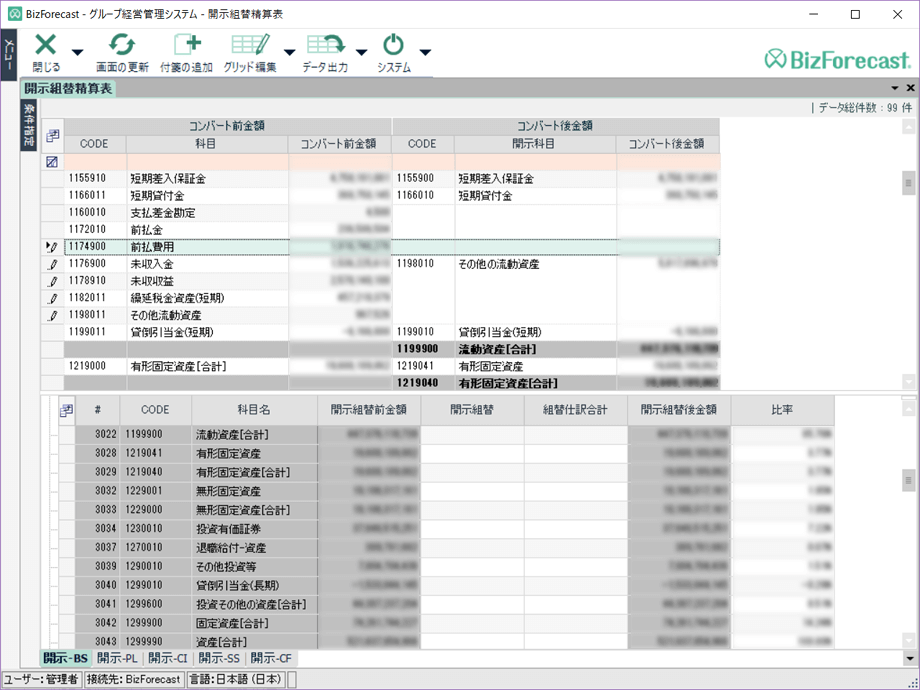

2. Reclassified Journal Registration and Reclassified Worksheet for Disclosure

Based on the granularity conversions and item connections that have been defined, you can display and verify the reclassification process in a worksheet format, and see how account items from a trial worksheet or financial statement are reclassified into a disclosure financial statement.

You can also register the journal entries on the basis of reclassified disclosure accounts.

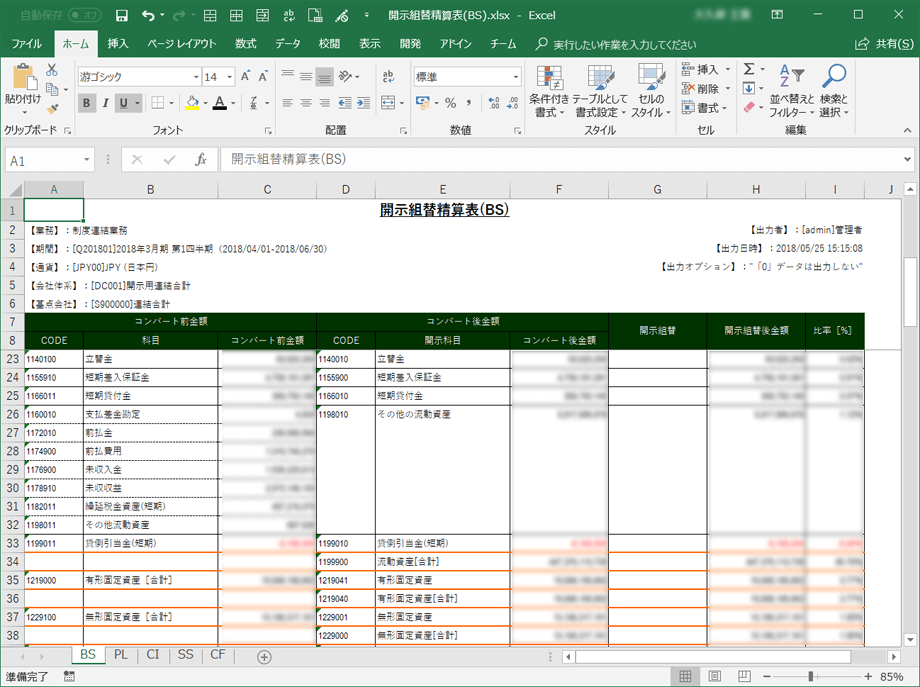

3. Disclosure Reclassification Table (Report)

After reclassification, you can output the whole process in an Excel format as Disclosure Reclassification Table (Report), which will contain reclassified journal entries, item values after the reclassification, and the granularity conversion process of items from a trial worksheet or financial statement to a disclosure report or statement.

You can also output, in a CSV or Excel format, data with matching specifications and layouts that can be linked to any disclosure support systems offered by securities printing companies or the like.

Common Account Items for Disclosure

You can even manage data that are not in financial statements, such as notes and remarks with qualitative (text) information, unitarily in a tree structure as "common disclosure data."

Any data managed as common disclosure data can be put on any places on any reports, so that you can create highly complex reports and documents.